Share :

Introduction

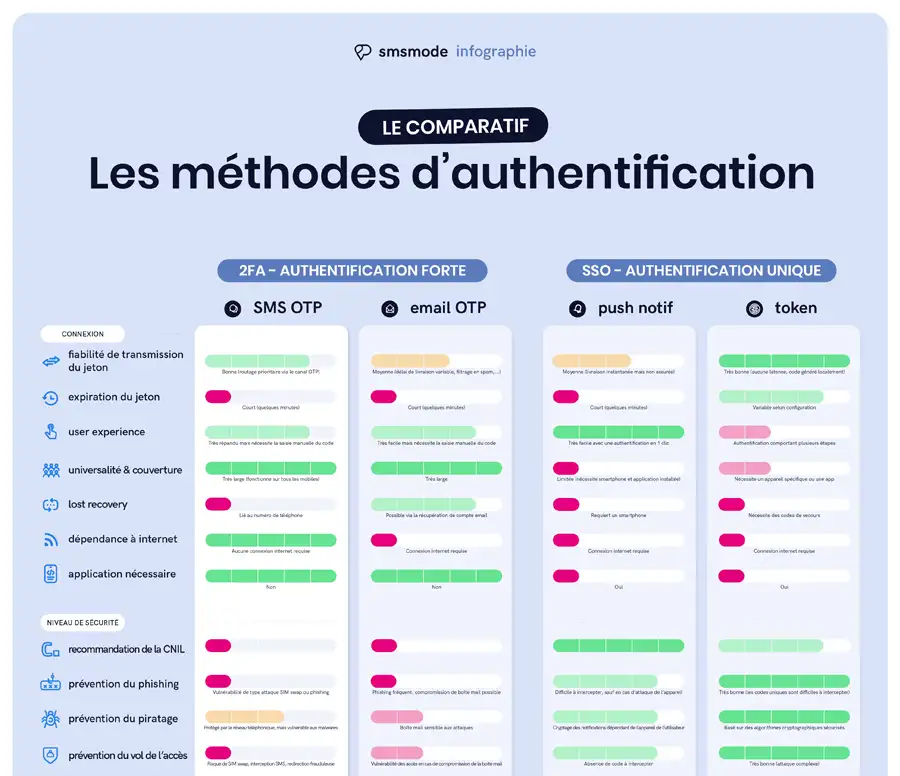

Reducing the risk of fraud without hindering users in their login or account creation processes is a concern for many companies. The most common method for ensuring user security within an application is verification at login, i.e. authentication. Several solutions exist, but how do you adopt the one that will be the most effective and secure, while minimizing costs?

What are the different forms of authentication at SMS ?

Simple authentication using SMS

Simple authentication via SMS allows the user to connect to an account without providing a username or even a password. Once the login address has been entered, an SMS OTP (One Time Password) is sent to the cell phone of users who enter the code to connect to the application. It's a fast and easy way to verify that you have a cell phone, so there's nothing to remember. However, the phone is the only authentication factor, which makes this method more fragile.

Two-factor authentication (2FA)

Two-factor authentication via SMS is the most widely used method. It allows you to reinforce your existing security system while benefiting from easy and inexpensive implementation. Users enter their logins (name and password), and SMS including OTP codes are sent to provide additional verification at login. With this two-step authentication, you benefit from enhanced security for all connections to your applications.

Multi-factor authentication (MFA) with SMS

Multi Factors Authentication (MFA) is a multi-step (usually 3) verification method before granting access to a system, application or data. The aim of MFA is to reinforce security by ensuring that the person attempting a connection is who they claim to be.

This authentication is based on :

- Something you know (knowledge factor: password, PIN code)

- Something you own (possession factor: phone, computer)

- Something you are (biometric factor)

In practice, when connecting to an online banking application, for example :

- Step 1: Enter username and password (knowledge).

- Step 2: Receive a verification code by SMS on your cell phone and enter it in the application (possession).

- Step 3: Use your fingerprint to unlock the authentication application on your phone (biometric factor).

This method is the most reliable, as it is very difficult to forge/submit 3 verification factors at once. On the other hand, MFA represents a major development effort and can be complex to activate, especially for simple connection operations where 2 separate factors are more than sufficient.

When should SMS OTP be used for authentication?

This type of SMS containing codes has gained notoriety for its use in securing online credit card payments. But SMS "One Time Password" can be used for many other purposes:

- Connection to online banking or trading services (stock portfolio, crypto...)

- Access to social media accounts, video and audio streaming, content management, software development platforms, e-mail accounts and cloud services

- Registration and verification of new user accounts

- Connection to a messaging or file storage application

- Password reset

- Authentication for corporate portals or teleworking platforms

- Access to e-commerce, delivery and logistics platforms

- Certified electronic signature

- Identity verification for information, government, health or sensitive services

- Access to human resources management systems

- Connection to online gaming forums or networks

- Validation of travel bookings and electronic tickets

Understanding dual authentication ? How to deploy an authentication process? Which technologies and methods?

The applications for these codes are virtually endless in the web and mobile world! smsmode© recommends that all companies using personal accounts with private data for their users implement authentication via SMS. You can really increase secure connections to your application or to unsecured networks with SMS OTP by sending temporary passwords.

Similarly, when registering a new customer, you can check their phone number with a code per message and ensure thatthe information is correct.

This process not only enables you to connect for the first time, but also guarantees you a certified database, enabling you to qualify your leads.

It is also possible to certify an electronic signature, enabling you to validate contracts remotely thanks to the codes generated.

What are the advantages of authentication via SMS ?

A significant convenience for the end-user: the use of cell phones in the account security process means that a code can be received very quickly on a medium that's close at hand. With immediate reception, the transmission of a unique unique code by SMS secures operations while making connections more fluid.

A universal medium that works on all mobile terminals and all global networks, giving all users a feeling of security, whatever their cell phone. Everyone will be aware of the security system protecting their personal data. And you won't need to develop an additional application to activate verification.

Certified collection of your customers' cell phone numbers to enrich your contact database with quality data: thanks to OTP, when a customer registers on your website, they can enter their phone number. This number is not always valid, and your database is therefore inaccurate. When they register, a code transmitted by SMS enables them to validate their number directly on your application or website.

Seamless integration and easy administration: this service is completely free of charge, and you will only be billed for SMS .

Why adopt the solution smsmode© ?

- telecom operator

- High priority backup providers

- Dedicated channel only for OTP

- Guarantee that 95% of messages are received in less than ten seconds

- Monitoring 24/7

- Measuring tools with time to receive, traffic, and alerts

How to implement the SMS "One Time password"?

When you use ourstrong authentication solutionat SMS, you benefit from :

A powerful, documented REST API to implement SMS OTP. An alphanumeric code is automatically generated by your application or website. The OTP code is single-use, and its expiry date is defined in advance by your team. The SMS OTP routing implemented via the API is responsible for transmitting this code as quickly as possible via a high-priority channel dedicated exclusively to this type of transmission.

The routing of SMS 2FA or OTP to France, DOM-COM or international destinations is carried out on a dedicated, priority channel that is constantly monitored by our monitoring tools. The use of our web services also guarantees maximum security and total confidentiality of your data (encryption and hashing of user data).

Diversify your payment methods, offer the payment link sent by SMS

Create your free account

Try out our SMS platform and benefit from 20 free test credits, with no obligation.