Share :

Introduction

Fintech, the fusion of finance and technology, is disrupting the traditional banking sector through technological innovations. Among the solutions used by this sector, the strategic use of mobile messaging is a powerful tool for improving protection, communication and customer experience. Find out how finance companies are integrating short messaging to build strong relationships with their customers and protect their data.

SMS to streamline banking operations

Short Message Service plays an essential role in strengthening interactions within start-ups and innovative banks. As a direct and instantaneous communication channel, it enables companies to communicate effectively with their customers. From payment or contract reminders to transaction notifications, messages are of paramount importance in keeping customers informed in their financial activities. Many companies in the innovative banking sector, such as microcredit specialist Finfrog, use our solutions on a daily basis.

Text messaging is also a channel that greatly simplifies financial processes. By providing users with instant access to their financial information, SMS speeds up all interactions.

Whether for :

- Fill in forms

- Receive authentication codes

- Make a payment

- Validate the electronic signature of a contract

Our sending solution, also available via API, can help you reduce barriers to accessing financial services. By eliminating delays, oversights and friction, messages improve the fluidity of banking operations.

Security: the pillar of financial platforms, supported by the SMS

Beyond its communication function, the short message is a strategic protection tool that is particularly effective in the financial sector. It can be found in many different situations.

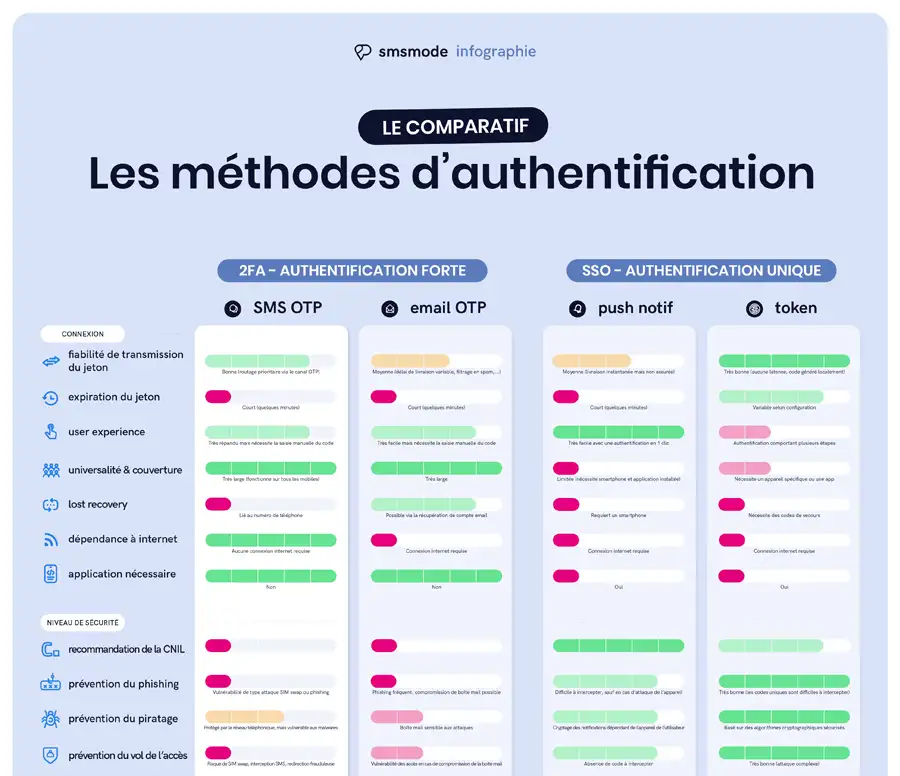

Two-factor authentication (2FA)

Users receive a unique authentication code (One Time Password) by SMS which they must enter in addition to their password to access their account. The 2FA by SMS adds an extra layer of assurance by verifying the user's identity, and blocks over 99.9% of account compromise attacks.

Transaction confirmation

This well-known method for online payments has been replaced in Europe by 3D Secure, but is still widely used by online financial platforms generating virtual cards. When large payments are initiated, a SMS OTP is sent to the account holder to confirm the transaction and prevent fraudulent transactions.

Electronic signature

The One Time Password is very useful in electronic signatures, as it provides a legal guarantee of the signatory's identity and the integrity of the signed document. An OTP is generated for 1 signatory and 1 contract. The signatory re-enters this code received by message on the contract. This action is the legal basis of consent for a remote signature.

Suspicious connection alerts

If a suspicious connection is detected on a user's account, an alert message is sent to inform the user and enable them to take rapid action to secure their account.

Notification of an important change to the account

If a user changes their password or personal data, a short message can be sent to confirm the change. This ensures that the account holder is aware of any changes to their information.

Balance or activity alerts

Customers can receive alerts to be informed in real time of any activity on their account, such as a large payment or a change in balance.

Password reset

This is a more secure alternative to sending a password reset link by e-mail. A telephone number is a better guarantee of identity than an e-mail.

Identity verification for customer support

When a user contacts customer service with account-related questions, an identity verification message may be sent to ensure that the user is the account holder.

This extra layer of protection guarantees the confidentiality and security of transactions and sensitive data. Messages thus become a reliable shield, helping to build trust among users of online financial services.

Understanding dual authentication ? How to deploy an authentication process? Which technologies and methods?

SMS for customer experience in Fintech

The use of mobile messaging in online financial platforms also offers other significant functionalities for improving the user experience. Here are just a few of them!

Personalization and proximity

Thanks to customizable variable fields and segmentation of the contact base, mobile messaging allows you to play the proximity card effectively. This is particularly valuable in the banking sector.

By tailoring messages to users' profiles and preferences, companies canstrengthen ties and create a unique experience for their customers. This personalization generates a sense of appreciation and involvement that helps build a solid climate of trust.

Proactive information

With its record open rate, text messaging is the perfect channel for notifying and informing, with the assurance of being read. Companies can therefore take a proactive approach by sending out information on new offers, policy changes and more. It's an excellent way for a brand to demonstrate its commitment to transparency and customer satisfaction, while sparing them any unpleasant surprises. This strategic approach strengthens loyalty and guarantees a positive experience.

Mobile messaging as a financial education tool

It can also be a good channel for an educational approach. Banking companies can provide their customers with information and advice tailored to their specific needs throughout their investment journey. This approach makes it easier to assimilate financial concepts and encourages informed decision-making.

Consumers can also be guided through these learning stages by a chatbot SMSThe short message becomes a strategic awareness-raising tool, leading individuals towards greater control of their financial situation and loyalty to your solution. The short message becomes a strategic awareness-raising tool, leading individuals towards greater control of their financial situation and loyalty to your solution.

In addition, they can include links to reliable external resources, such as government articles or reference guides on financial management. This strategy enables users to deepen their knowledge and acquire the financial skills essential for using banking products.

10 tips for notifying and building loyalty with SMS

In this guide, identify the touch points where SMS improves the customer experience.

SMS in the banking sector: driving behavioral change

The use of mobile messaging in this specific sector is therefore not limited to distributing information or validating payments, but also encourages responsible financial behavior. The short message encourages users to put what they've learned into practice, using all the available functions. These include budgeting, financial balance sheets and savings planning. Periodic reminders and financial tips delivered by message act as catalysts for positive action. This encourages consumers to take concrete steps to improve their financial well-being. In this way, the mobile medium becomes a driver of behavioral change, transforming financial empowerment into an interactive and dynamic process.

In conclusion, the strategic integration of Short Message Service into the financial innovation industry has opened up new perspectives for security, customer experience and communication. By using it in a targeted way, financial companies are at the origin of a virtuous circle that leads customers and companies to success.

Create your free account

Try out our SMS platform and benefit from 20 free test credits, with no obligation.